Keywords: Log-normal Dynamics, Hull-White Short Rate Model, Forward Rate Pricing, Non-linear Pricing, Monte-Carlo Simulation, Calibration

Description:

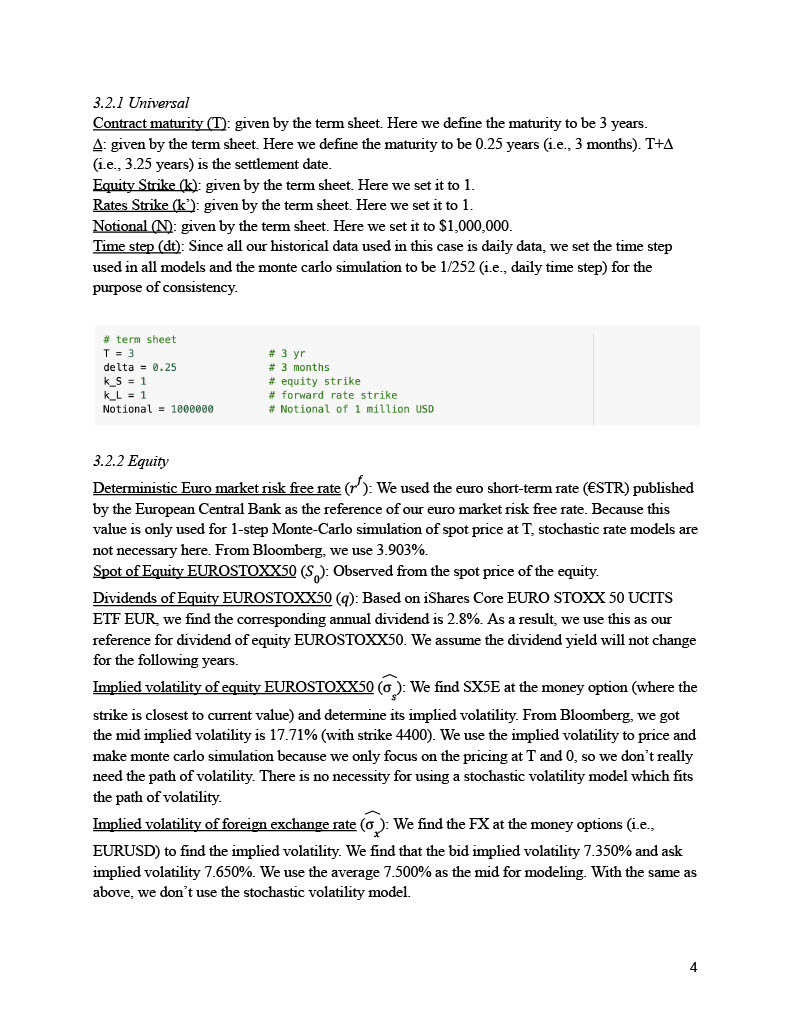

This project entailed the construction of a complex quantitative model to value a $1 million notional quanto contract tied to the EUROSTOXX50 index.

It involved synthesizing log-normal equity modeling techniques for European market simulation and integrating an enhanced

Hull-White model for predicting short-term interest rate behaviors. Utilizing Bloomberg’s historical data from 2018 to 2023,

the project’s scope included rigorous Monte Carlo simulations under different financial measures to capture a broad spectrum of

market conditions. These simulations yielded a valuation range, reflecting the contract’s sensitivity to market volatilities and

exchange rate dynamics, and provided a deep dive into risk assessment and mitigation strategies within the domain of cross-currency

financial instruments

Report: Please mail to me (hw2894@columbia.edu) or through the mail symbol at the right bottom.